What is Open Banking?

Open banking is a mandate for Deposit-taking Institutions (aka Banks) to make their product and customers data available via Application Programming Interface (API) to accredited entities.

Right now, it’s difficult for you to get a hold of your full financial data and for banks to send that data to each other and to other companies. This traditional siloed approach has made it difficult for consumers to find and switch to the best product or service based on their personal circumstances.

The main driver for Open Banking initiative is to improve competition by enabling consumers to have more power over their own data and being able to share it with other businesses for better offers.

A bit of history

It all started in Europe!

In October 2015, the European Parliament adopted a Payment Services Directive, known as PSD2. In summary it included the use of innovative online and mobile payments through open banking.

UK was one of the early adopters and in August 2016 issued a ruling that required the nine-biggest UK banks to allow licensed start-ups direct access to their data down to the level of transaction-account transactions.

Not long after Australia jumped on the bandwagon and mandated Big Four banks (CBA, NAB, Westpac and ANZ) to make certain financial data available.

When will it be available in Australia?

Big 4 are required to productionise their API by Feb 2020 for certain products such as credit and debit cards and deposit accounts, and over the following months gradually make other information available such as loan accounts and transaction data. By mid-2021 all banks need to provide access to their products and customer account and transactions.

How does it work?

What data will be available in Open Banking API?

· Product data: Information about rates, fees and features for each bank’s products. In most case this doesn’t need authentication as the data is publicly available and is not sensitive.

· Customer data: Personal information about you such as your phone number, email address and home address.

· Account data: This includes information about specific accounts such as balances, direct debits and regular repayments.

· Transaction data: information about the transactions on your account, including how much you spent and where you made the transaction.

Who can access your data through Open Banking API?

Only accredited entities who meet the criteria specified by the authorities can access consumers data via Open Banking. These entities range from Fintech start-ups, to the banks, insurance companies, telco and other organisations with interest in providing value-add products and services by accessing consumers financial data.

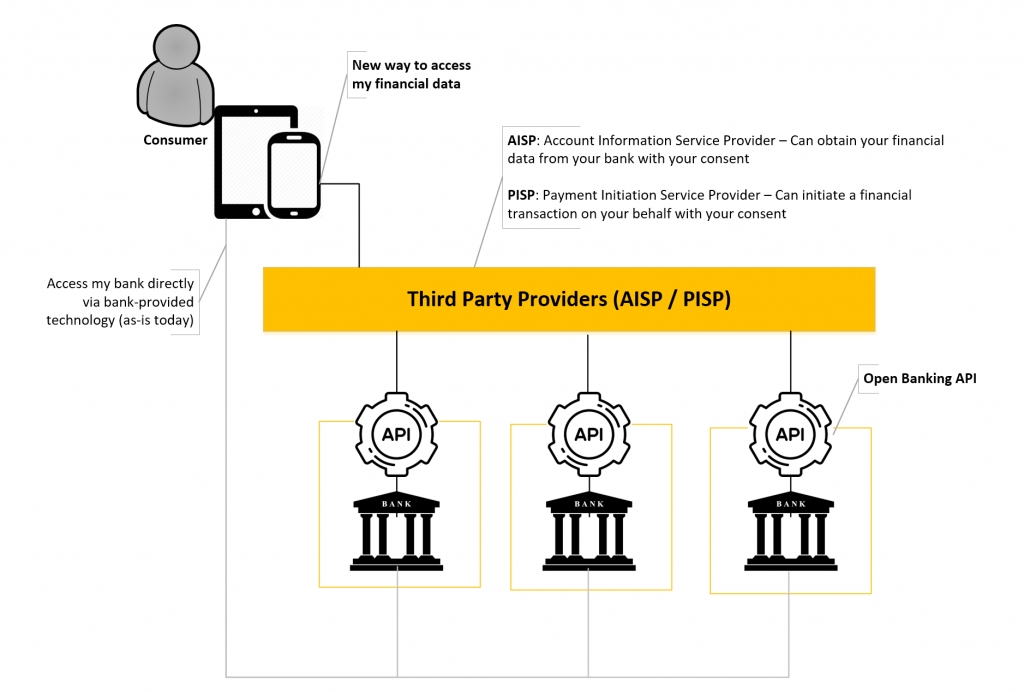

The accredited entities can assume either or both roles below:

1. AISP: Account Information Service Provider – Can obtain your financial data from your bank with your consent.

2. PISP: Payment Initiation Service Provider – Can initiate a financial transaction on your behalf with your consent.

The consumer will have full control over sharing their financial data with the third parties and need to explicitly give consent to their banks to share data with an AISP or PISP.

Note that your bank can also get accreditation to act as an AISP and PISP to get your personal or financial data from your other banks.

So, what’s the benefit to the consumer?

There are countless of scenarios where AISP’s and PISP’s can add value to the consumers.

Imagine an AI-enabled App which can go through your financial data such as income, spending habits, outstanding home-loan debt and value of your assets, and create new offers for you which you can apply for and enjoy a much better deal such as a better home-loan rate with another bank or a better-value car insurance.

Opportunity for businesses

There are opportunities which can be unleashed by accessing Open Banking API, either directly as an AISP/PISP or by using third-party services.

This area is in its infancy but some of the potential use cases include Digital Identity Verification using banks’ established KYC methods, digitally obtain consent from the client and debit their account for products and services, fraud detection by analysing spending patterns, create “Next Best Offer” based on customer’s financial transactions and assets, amongst others.